Navigating business closure in the UAE demands a proactive approach to understand the landscape of legal procedures and financial considerations. Winding up any organisation is a critical undertaking that requires entrepreneurs to actively engage with specific steps and insights for a smooth and compliant process.

In this article, we will actively explore the essential steps and insights crucial for businesses contemplating business closure in the UAE in the dynamic business environment of the UAE. From legal requirements to financial considerations, this guide aims to empower business owners with the knowledge and insights necessary to navigate the complexities of closing a business in the UAE.

The business closure landscape in the UAE

Exploring the intricacies of business closure in the UAE involves delving into a multifaceted landscape that encompasses various matters. Business owners actively engaged in the process must navigate a well-defined framework to ensure a smooth and lawful closure.

Firstly, at the forefront of this landscape are the legal requirements that necessitate proactive adherence to specific procedures. Business closure demands active involvement in understanding and complying with regulations, encompassing everything from notifying authorities to settling outstanding liabilities.

Financial considerations add another layer of complexity, requiring meticulous planning and execution. Business owners actively participate in assessing and addressing financial obligations, which may include settling debts, liquidating assets, and contractual commitments. This active engagement is fundamental to mitigating financial risks and ensuring a responsible exit strategy.

Moreover, compliance measures are a cornerstone of the business closure landscape. Business owners must actively collaborate with regulatory bodies, ensuring that all statutory obligations are met. This includes obtaining the necessary approvals, trade canceling licenses, and fulfilling any other obligations specified by UAE authorities. The active involvement in compliance measures is pivotal not only for legal adherence but also for safeguarding the reputation of the business and its stakeholders.

Furthermore, in this dynamic environment, business closure in Dubai is far from a passive process. It demands a proactive and strategic approach that considers the unique challenges posed by the UAE’s regulatory framework. The active exploration of the business closure in the UAE landscape involves continuous learning, staying informed about any updates, and adapting strategies accordingly. Business owners, actively steering through this landscape, must seek professional advice, engage with legal and financial experts, and maintain open communication with stakeholders.

Legal requirements and documentation

Navigating business closure in the UAE entails a meticulous understanding and active adherence to legal requirements and documentation. Business owners actively engaging in this process must recognize the pivotal role that legal compliance plays in ensuring a smooth closure within the regulatory framework.

Firstly, active participation involves informing relevant authorities about the decision to close the business. This includes submitting a formal business closure notice to the Department of Economic Development (DED) and other applicable regulatory bodies. The active communication of closure intentions initiates the official process and sets the groundwork for compliance.

Simultaneously, business owners must settle any outstanding liabilities with creditors, suppliers, and other stakeholders. Addressing financial obligations is a key legal requirement that contributes to the ethical and lawful closure business process.

Actively obtaining a clearance certificate from the respective authorities is another crucial step. This document attests to the business’s compliance with financial and legal obligations. As part of the closure process, requiring it is instrumental in obtaining the final approval for closure.

In addition, business owners must actively cancel any relevant licenses, permits, or visas associated with the business. This involves initiating the cancellation process with the relevant authorities and providing the necessary documentation to support the cancellation.

On the other hand, throughout these active steps, maintaining clear and organized documentation is imperative. Business owners must compile all necessary paperwork, including financial records, clearance certificates, and cancellation documents. This ensures a comprehensive and efficient submission of required documentation to the authorities involved.

Moreover, actively seeking legal counsel throughout this process is advisable. Legal professionals can guide business owners in understanding the specific legal requirements, assist in drafting the letter for business closure, and ensure that all steps are compliant with UAE laws and regulations.

Financial considerations

Business closure in the UAE necessitates active engagement in comprehensive financial considerations. Business owners involved in this process must navigate various financial aspects to ensure a responsible and solvent closure.

Firstly, participation involves conducting a thorough financial assessment. Business owners must evaluate the company’s financial standing, taking stock of assets and liabilities. This evaluation forms the basis for developing a sound financial strategy for closure.

Moreover, actively settling outstanding debts is a paramount financial consideration. Business owners must engage with creditors and suppliers to negotiate settlements, clear dues, and fulfill financial obligations. This proactive approach contributes to a responsible and ethical exit from the business landscape.

Simultaneously, business owners must take measures to liquidate assets. This entails selling assets, inventory, or equipment to generate funds, facilitating the settlement of outstanding debts, and covering closure-related expenses.

In addition, business owners must plan for employee settlements, including gratuities and final settlements. This requires communication with employees, ensuring transparency, and fulfilling legal obligations related to employee compensation.

Active consideration must also be given to tax implications. Business owners must engage with tax authorities, settle any outstanding tax liabilities, and obtain necessary clearances. This ensures compliance with tax regulations and mitigates potential legal complications.

On this financial journey, business owners must keep accurate financial records. Maintaining organized financial documentation is crucial for transparency, legal compliance, and facilitating a smooth closure process.

Furthermore, seeking financial advice and consulting with financial experts is advisable. Financial professionals can guide business owners, helping them make informed decisions, optimize financial outcomes, and ensure that they handle closure business matters responsibly.

Employee rights and responsibilities

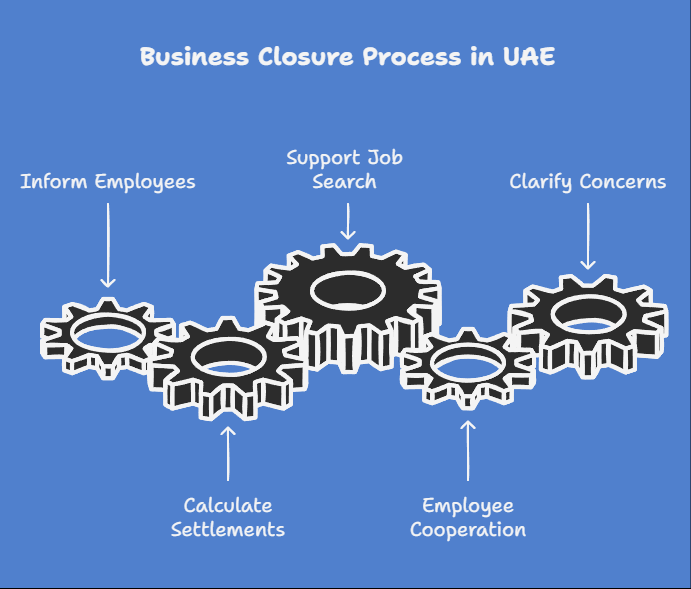

In the scenario of a business closure in the UAE, it is crucial to understand and address the rights and responsibilities of employees. As a business owner involved in this process, you have a responsibility to communicate openly and honestly with your employees.

First and foremost, informing your employees about the closure is essential. You should provide clear and transparent communication, explaining the reasons behind the closure and the timeline of the process. This ensures that employees are well-informed and can plan for their future.

Settling employee rights is another key aspect. This includes calculating and providing any gratuities or final settlements owed to employees. Engage with your employees to ensure you acknowledge and fulfill their rights during this transitional period.

On the other hand, consider providing support for employees in their job search. Offering assistance, such as providing references or connecting them with relevant networks, contributes to their smooth transition to new Business Opportunities.

Simultaneously, employees have responsibilities during the closure process. They should cooperate with the procedures laid out by the business. This involves returning company assets, completing pending tasks, and cooperating with administrative processes.

Additionally, employees should engage with the employer to clarify any concerns or seek additional information about the closure process. Maintaining an open line of communication helps address any uncertainties and ensures a more collaborative approach during this time.

Practical steps for closure

When navigating business closure in the UAE, it is essential for business owners to engage in practical steps to ensure a smooth and compliant transition. This involvement requires a strategic and hands-on approach.

To commence the closure journey, business owners must communicate their decision to relevant authorities. This involves the submission of formal notices to entities such as the Department of Economic Development (DED), officially initiating the closure process and setting the groundwork for compliance.

Concurrently, active measures should be taken to settle outstanding debts with creditors, suppliers, and other stakeholders. Proactively fulfilling financial obligations contributes to an ethical and responsible closure.

Simultaneously, obtaining necessary clearances is paramount. This includes securing a closure certificate from relevant authorities. Taking this step ensures meeting all regulatory requirements before concluding operations.

Next in the checklist is the cancellation of licenses, permits, or visas associated with the business. Business owners must initiate the cancellation process and provide the necessary documentation.

Throughout this process, maintaining organized documentation is imperative. Business owners should keep clear records of financial transactions, clearance certificates, and cancellation documents. This approach streamlines the closure process and ensures compliance.

For added guidance and assurance, it is advisable to consult professionals in Business Strategies who can help align the closure with UAE laws.

KPM PRO tackle challenges and helps you with Company liquidation

At KPM PRO, we understand the challenges businesses face during business closure in the UAE. We tailor our approach to actively guide you through a seamless company liquidation process.

We assess your situation, communicate with authorities, and strategize for debt settlement. We handle regulatory paperwork, help obtain closure certificates, and manage cancellations of all licenses, permits, and visas involved.

With us, you benefit from expert support and transparent guidance throughout your closure business journey.

Conclusion

In conclusion, the process of business closure in the UAE demands a proactive and strategic approach. Essential steps include official business closure notice submission, financial obligation settlement, and regulatory clearances.

With professional guidance from KPM PRO, this process becomes streamlined, ethical, and legally compliant.

To learn more, check out our Blog for insights on Business Strategies or visit our Contact Us page to explore services that support your business through every phase.

FAQs:

What is the process for closing a business in the UAE?

You must notify authorities, settle debts, and cancel licenses and visas. Don’t forget to obtain final clearance certificates from regulatory bodies.

Do I need to liquidate my company to close it in the UAE?

Yes! Liquidation is required to legally:

- Close a company

- Settle liabilities, and

- Finalize regulatory and

- Financial obligations.

What is the difference between cancelling a trade license and liquidating a company?

Cancelling a trade license ends business activity. Whereas liquidation involves selling assets and clearing debts before full closure.

How long does it take to close a business in the UAE?

On average, business closure in the UAE takes 4 to 8 weeks. The closure depends on the company type and approvals.