Offshore corporations are ones that are meant to be established in a country but operate outside of the jurisdiction of registration. In other words, it is a firm or investment that is registered in one jurisdiction but operates in various countries.

Understanding the distinction between free zones and offshore companies in the UAE is critical. The former is intended for business management with the company’s physical presence in Dubai. In contrast, offshore companies allow you to have an office address and registration in the UAE without being permitted to conduct direct business activities.

Both individuals and corporations with authorized offshore licenses can be owned Offshore companies. The company’s operations and commercial transactions in the nation of registration are restricted. Apart from mainland and free zone business creation, the license issue process does not apply to offshore company formation in the UAE. For the same reasons, you may complete the offshore business setup services in the UAE without delay.

Primary Benefits of Offshore Company Establishment in UAE

Offshore company establishment in the UAE offers various advantages, including:

- Offshore corporations in the UAE allow complete foreign ownership without a local partner.

• Enjoy tax benefits such as no company taxation, income taxes, or VAT.

• Protects shareholder and director identities with high privacy standards.

• Offshore firms are perfect for protecting assets, including real estate, shares, and intellectual property.

• Offshore enterprises may engage in worldwide commerce without currency restrictions. •Regulatory and reporting requirements are eased, making management easier.

• You may open multi-currency bank accounts to facilitate international financial transactions.

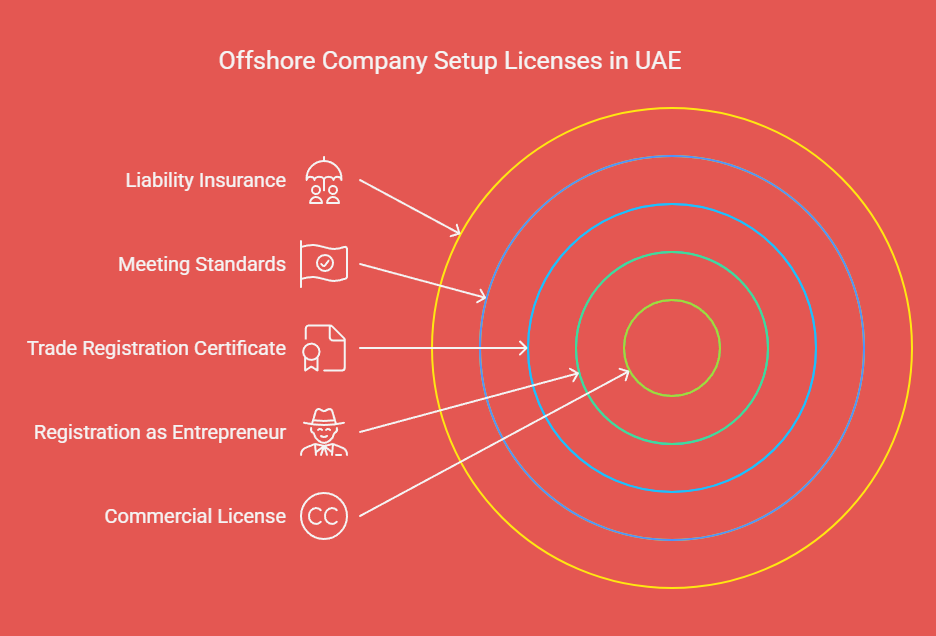

Offshore Company Setup Licenses in UAE

You must consider particular licensing categories while setting up an offshore corporation in the UAE. Three types of offshore licenses are available for offshore companies: commercial, professional, and industrial.

The license your firm requires is determined by its nature, type, and size. You can apply for an offshore license online through regulatory agencies’ official websites or in person at their offices.

Required Documents for Offshore Company Establishment

The offshore company required specific documents for business establishment in the UAE. These documents are offshore company Articles of Association, shareholder passports and CVs, Emirates ID cards, comprehensive business plan, certified copies of recent bank statements for the previous six months to be documented, proof of address via utility bill, three potential brand or business names, and details of business activity.

Licenses for Offshore Company Set up in UAE

When you apply for an offshore license in UAE, you will be given many alternatives that match your preferred business activity. Let’s look at some of the other options open to you:

General Trading License for Offshore Companies:

It’s a general trading permit for offshore companies to operate trading activities, such as import, export, and retail goods and products.

Holding License for Offshore Companies:

A holding license allows your offshore firm to acquire and control assets such as other companies’ stock, real estate, and intellectual property, simplifying strategic investment and wealth management.

Investment License for Offshore Companies:

It’s an investment permit for offshore businesses to invest in business activities, like purchasing shares in other companies and holding a diverse significance in the market.

Ownership for Offshore Companies in UAE

A completely owned foreign firm has a greater minimum capital than enterprises with local partners. A Limited Liability Company (LLC) with a local partner usually requires fifty percent local ownership, while the minimum capital requirement may be lower depending on the Emirate and company type.

Offshore Company Establishment Costs

The cost of forming an offshore company in Dubai varies depending on the size and nature of the business you wish to start. If you want to start an offshore business in a free zone, the cost will be more than if you set up your firm on the mainland. However, the benefits of establishing your corporation in a free zone include tax-free status and full foreign ownership. Establishing an offshore business in Dubai is likewise easy and quick.

Taxation for Offshore Companies in UAE

As a new entrepreneur, you must pay taxes in the UAE. The amount of tax you pay will be determined by the business types you operate and your income. The other strategies to lower your tax obligation include forming an offshore company.

An offshore corporation can be used for various purposes, including asset management and business operations outside the UAE. If you want to launch an offshore firm, there are a few things you need to know.

First, you must select a jurisdiction, like a free zone or mainland in the UAE. Once you’ve decided on a jurisdiction, you must create a corporate bank account and register your business with the local authorities. To do so, you will require documentation such as your personal ID card and passport.

Next, go online and locate the form that corresponds to your offshore business setup service provider. Before submitting this form, be sure you fill out all of the essential information (you will generally receive assistance from the service provider).

Once everything is correctly filed, your offshore corporation should be operational within four weeks. You’ll also have to appoint directors and shareholders. Directors represent the management team, whereas shareholders represent individuals who own stock in the firm. It is critical to include these personnel in your offshore business setup since they control what occurs when anything goes wrong.

Conclusion

Starting an offshore company in Dubai requires meticulous preparation and experience for the best outcomes. To successfully traverse the offshore license in Dubai procedure, you must know the legal requirements and grasp the UAE legal framework.

KPM PRO has years of experience in the sector and can assist you with smooth and effective business creation. Our professionals have firsthand knowledge of the offshore business application process. Acquiring visas for you and your staff, and simplifying day-to-day operations.

FAQs:

What is an offshore license in the UAE?

It is a license for companies incorporated outside the UAE mainland and free zones for international business operations.

Can an offshore company conduct business within the UAE?

No. Offshore companies cannot conduct local commercial activity.

What is the difference between offshore, free zone, and mainland licenses?

Offshore offers international operations. Free zones offer full ownership with limited onshore activity. Mainland allows unrestricted UAE operations.

What documents are required to set up an offshore company?

Passport copies, company forms, shareholder details, and supporting documents.

Can foreign investors own 100 percent of an offshore company?

Yes. Full foreign ownership is permitted.

Are UAE offshore companies subject to corporate tax?

Most offshore jurisdictions offer tax exemptions.