The UAE’s thriving economy and varied employment markets draw talent from various nations. It’s a lively and dynamic work environment that fosters a rich culture and innovative business practices. It is important to ensure equitable payroll practices, given the transnational nature of the workforce. All firms must comprehend the complexities of payroll administration to comply with the UAE’s WPS.

Setting a wage protection system is an effort to create a secure and reliable workplace and encourage responsibility and transparency. It demonstrates the UAE’s dedication to upholding workers’ rights to support its quickly expanding economy.

WPS in UAE: An Introduction

What is the wage protection system? An electronic compensation transfer system called the Salary Protection System (WPS) was created to protect staff earnings while employed by a corporation. It guarantees correct and timely salary payments via banks or other company-authorized financial institutions. By decreasing wage-related disputes, defending workers’ rights, and guaranteeing adherence to UAE labor regulations, it fosters a just and safe workplace.

Primary Objectives and Aims of UAE WPS

- Promises that wages are paid on schedule.

- Optimizes payroll processes, minimizes administrative burden for payroll processing, and steers clear of legal issues.

- Enhances job security for workers in the private sector in the United Arab Emirates by promoting an open and safe salary distribution system.

- Minimizes the possibility of conflicts by tracking and monitoring the employee’s payment.

- Provides a trustworthy personnel database that is updated regularly.

- Promotes a favorable working environment for both companies and workers.

WPS Impacts and Benefits on the UAE Employment Landscape

To hold all employee information for payroll processing, the WPS wage protection system in the United Arab Emirates maintains a consolidated database. It is verified by the UAE’s Central Bank and MOHRE and mandates that businesses update pertinent data.

According to WPS regulations, it may stop companies from using illicit money, postpone paycheck days, and pay incorrect salaries. The following parties are engaged in the WPS in the UAE:

UAE Workers:

The individuals work for the payroll processing company. They must have valid labor cards to complete their wage protection system WPS payroll in the UAE.

Business Owners:

They assist in automating payroll functions by registering payroll procedures with MOHRE and WPS.

UAE Financial Institutions and Banks:

Any UAE bank or regulated financial institution can assist businesses in processing employee payrolls.

UAE Financial Representatives:

The UAE Central Bank has permitted additional banking institutions and financial representatives to use the WPS payroll procedure to pay salaries.

You are unaware of all of the benefits that the wage protection system in Dubai and the UAE provides to businesses if you believe its only purpose is to safeguard employees. Let’s examine these advantages:

Adherence To The Labor Law:

WPS is a monitoring tool that helps firms avoid labor law violations in the United Arab Emirates. It gives them adequate time to correct errors and avoid fines and work permit limitations, which may be expensive and interfere with company operations.

More Effective Standing:

Being a WPS-compliant employer shows that your business is dedicated to ethical labor standards. It affects your worth and standing among coworkers, customers, and the larger business community.

Streamlined Payroll Administration:

As previously said, the MOHRE wage protection system is a powerful mechanism that can be integrated with your business’s payroll system, minimizing human mistakes and discrepancies. Employers can more easily handle payroll across several departments or branches thanks to the uniform salary payment system it offers.

Increased Trust Among Employees:

Employers may increase employee confidence by providing regular, on-time payments via a transparent wage distribution system like the UAE wage protection system. It boosts the employee retention rate and fosters more staff devotion and satisfaction.

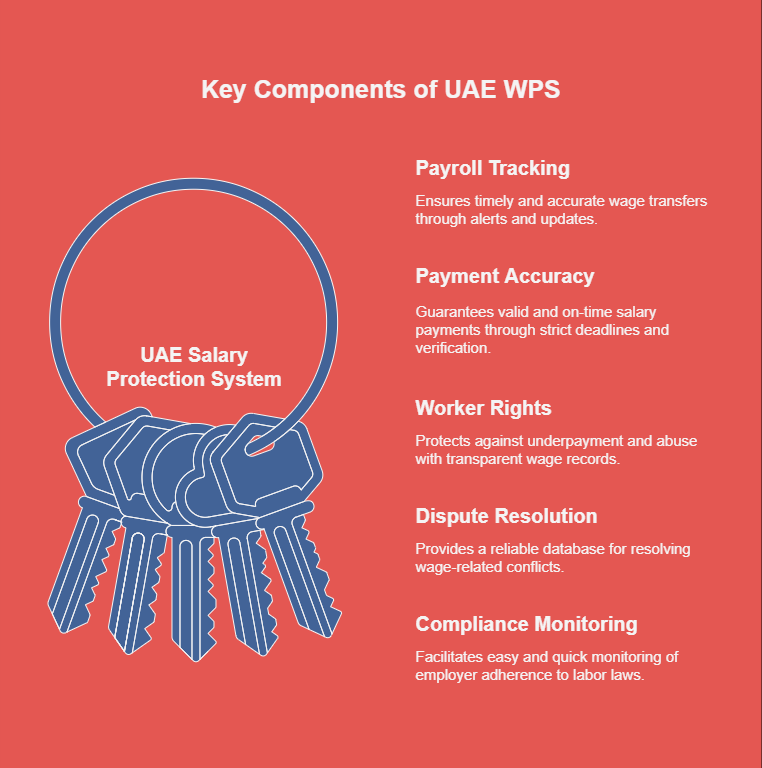

Considerable Features of UAE WPS

The UAE salary Protection System is extensive and contains several essential components to control salary payments. Let’s examine these qualities in more detail:

Tracking Payroll and Payments:

The WPS system tracks all wage transfers, and an alert mechanism guarantees that employees get their full and on-time pay. Additionally, it gives stakeholders up-to-date information on salary payments in the private sector.

Providing Precise and On-Time Salary Payments:

The system imposed rigid deadlines for processing salaries to guarantee that companies paid salaries on schedule. The wage protection system checks the legitimacy of payments against the provided Salary Information File to guarantee that payroll processing is valid and accurate.

Defending Workers’ Compensation Rights:

The WPS UAE system offers a strong legal framework that prevents insufficient payment and abuse by establishing an open record of wage payments. Both companies and workers gain from it since a transparent earnings record makes resolving disputes easier.

Controlling Wage Conflicts:

The system’s extensive database serves as a trustworthy resource for wage-related issues. Disputing parties may use the WPS’s data to settle wage disputes as verifiable proof of payment history.

Monitoring Employer Adherence:

Thanks to the WPS, authorities may now monitor employer adherence to UAE labor regulations much more easily and quickly. Any violations may be promptly found and dealt with.

The WPS Seamless Procedure for Employers

The Dubai wage protection system provides companies with a simple approach to ensuring seamless payroll processing and compliance. There is a sequential process:

Employer Authorization:

The initial stage for businesses is to apply with the MOHRE and a WPS-approved agent, such as a bank or financial exchange. According to your company’s structure, business nature, company size, and location, you must submit the required papers and agree to the WPS conditions.

Get Ready To Submit The Compensation Information File:

Employers must produce thorough compensation information files that include personnel information and wage data for each employee and send them to the WPS-approved agent in a precise manner. You can only perform these operations through the bank’s or agent’s website.

WPS Payment Verification:

The MOHRE and Central Bank evaluate the compensation information file supplied by the employer and compare it to the employee wage data to ensure compliance with labor regulations and information validity.

Payment Order Release:

Once validated, the employer sends a payment order to their WPS agent for the full wage amount. It is evidence of a legitimate and correct wage computation.

Compensation Transfer Guidelines:

The WPS agent handles the money transfer order and creates individualized compensation transfers in the salary information file.

Salary Disbursement to Employee Accounts:

Compensation is paid into specific worker accounts or wage cards, as defined in the compensation information file.

Legal Adherence for WPS

The Wage Protection Plan is simple to comply with. You only have to provide:

Your payroll team meticulously complies with WPS payment deadlines since failure to do so might result in significant penalties. Before launching your firm, register with certified financial institutions to guarantee compliance with Dubai tax regulations and WPS. Ensure that payroll creates and sends salary files in SIF format on time. Make sure your payroll records are up to date by using payroll software.

Audits are conducted regularly to observe WPS adherence. Adopt appropriate payroll solutions to guarantee accurate and timely payroll processing. Communicate clearly with workers about the WPS process, particularly its criteria, regulations, and effects. Avoid wage payment issues by using open methods and providing a resolution mechanism so workers may work with you rather than going to court.

Conclusion

Employers must comply with the WPS in the UAE. It offers a clear, effective, and secure payment option, builds confidence in staff members, and ultimately helps to create a more productive and peaceful workplace. They may consider a reliable PRO services provider to stay compliant and continue operations without hurdles.

FAQs:

What is the Wage Protection System (WPS) in the UAE?

The Wage Protection System (WPS) is a digital salary transfer platform created by the UAE government to make sure employees receive their wages on time. It allows companies to pay salaries through approved banks and financial institutions, ensuring full transparency and protecting workers’ rights.

How does the Wage Protection System work?

Employers upload payroll files to their bank or exchange house. Once approved, salaries are sent directly to employees’ accounts through WPS. The Ministry of Human Resources and Emiratisation (MOHRE) tracks every payment to confirm timely and accurate wage transfers.

Which employees are covered under the WPS?

All employees working in UAE mainland companies registered under MOHRE are covered. This includes full-time, part-time, skilled, and unskilled workers with active UAE work permits.

What are the penalties for late salary payments under WPS?

Penalties may include fines, suspension of work permits, and a freeze on new visa applications. Companies may also face inspections, legal action, or downgraded ratings if delays continue.

Is there a minimum salary limit for WPS transfers?

There is no official minimum salary requirement. All registered companies must pay their employees through WPS, regardless of salary amount.

What documents are required for WPS registration?

Documents generally include the company’s trade license, establishment card, employee details, labor contracts, bank account details, and the payroll file (SIF format) required for salary processing.

What are the benefits of WPS for employees?

WPS ensures secure, timely salary payments, reduces the chance of delayed wages, and provides full transparency. It also helps employees track their payments easily and improves overall financial protection in the UAE labor market.