When you are launching your dream business in the UAE, paperwork piles up, legal terms swirl, and one document keeps resurfacing: the Memorandum of Association. It is the piece of paper that gives your business its identity and the power to function in the UAE. Without it, your company doesn’t technically exist.

Getting it wrong means you risk disputes, fines, or a business that can’t breathe. Get it right, and you build on solid ground. But most new entrepreneurs only realise its importance when things start to go sideways like a dispute between partners or a licensing delay. That’s when the MOA becomes either your best friend or your biggest bottleneck.

MoA lays a foundation that’s built to handle real growth, real decisions, and real risks. Because not every co-founder agreement turns out fine. Let’s not get you in that mess. In this blog post, we discuss how you can conquer the UAE market with confidence.

What is a Memorandum of Association?

A Memorandum of Association is a legally binding document that outlines the who, what, and how of your company. It’s submitted during business setup and clearly defines the rules, roles, and responsibilities within your organisation.

In simple terms, it’s the rulebook that investors, partners, and government departments look at to understand how your business is wired. If your company is a machine, the MOA is the operating manual. And no, you can’t just wing it.

This document is not to be confused with the Articles of Association (AOA), which handles internal management and daily operations. The MOA is more about your company’s relationship with the outside world. It is the legal framework that keeps you compliant and credible. With it, you declare:

- What will your company do?

- Who are the shareholders?

- Where is your office?

- How much capital are you investing?

- What the shareholding percentages look like?

- What is the management structure?

All of this matters a lot when your business starts gaining traction. Or if someone wants to challenge your decisions in court.

Why Does MoA Matter?

Most founders don’t wake up excited about legal documents. And we don’t blame you. But here’s why you should care about your MOA:

Disputes Get Ugly Fast

If a business partner suddenly wants out or demands more profit, your MOA is the only thing that keeps things civil and legal.

Licensing Approvals Rely on It

A vague or incorrect MOA can hold up your license. That delay will cost you time, energy, and potential revenue.

Banks Ask for It

If you are planning to open a corporate bank account, you will need MOA.

Investor Confidence Depends on It

Investors want to know the business they are backing is structurally sound.

Future-proofing Is Built-In

A smart MOA leaves room for expansion, pivots, and transitions, so you are not rewriting your structure from scratch when it’s time to grow.

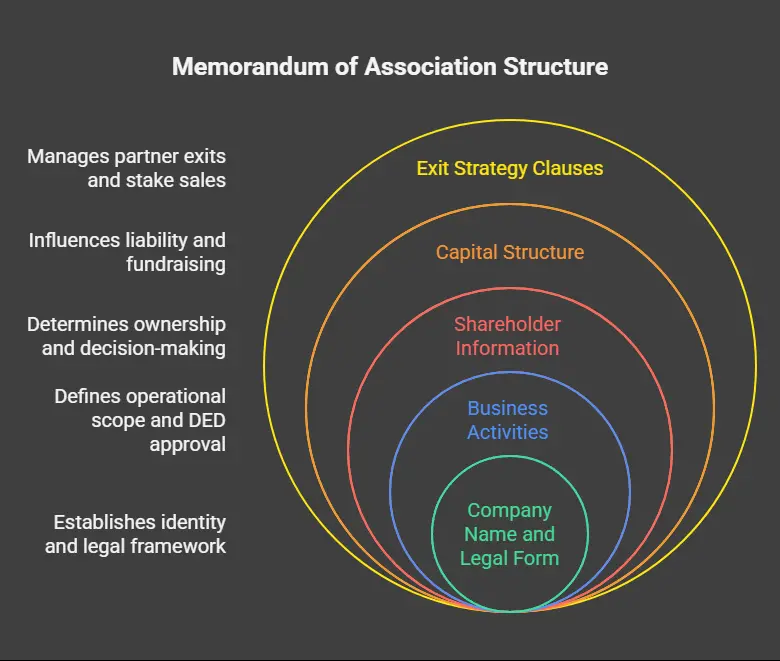

What’s Included in a Memorandum of Association in UAE?

Here’s what typically goes into a UAE MOA:

1. Company Name and Legal Form

You have picked a name, great. The MOA will make it official and lock in your legal structure (LLC, sole establishment, etc.). This also defines what legal rights and responsibilities you have under UAE law.

2. Business Activities

What will your company do? Be specific. Vague activities won’t get approved by the Department of Economic Development (DED).

3. Shareholder Information

Names, nationalities, shares owned, and capital contribution. This part has to be crystal clear. Shareholding affects decision-making power, profit sharing, and liability.

4. Office Address

Where your main operations will be based. Some free zones require a physical office lease as part of your registration.

5. Capital Structure

Total share capital, distribution of shares, and each shareholder’s stake. This can affect things like liability, dividends, and future fundraising.

6. Profit and Loss Distribution

How you will split the earnings or the losses among shareholders prevents disputes later, especially when the numbers start to matter.

7. Duration of Company

You can set a fixed duration or go with ‘indefinite’ if you are in it for the long haul. This is especially important for project-based entities or joint ventures.

8. Powers of Managers

Who’s calling the shots, and what decisions they can make solo versus needing shareholder approval. This helps establish decision-making boundaries.

9. Dispute Resolution Mechanisms

Some MOAs now include arbitration clauses or specify jurisdiction to avoid nasty court battles.

10. Exit Strategy Clauses

Think: buy-sell agreements, drag-along and tag-along rights, and what happens if a partner wants to sell their stake.

Legal Standing of MOA in the UAE

In the UAE, the MOA is a document recognized by every relevant authority. It must be notarised and legally attested before it becomes enforceable. That means your MOA carries legal weight in any business, licensing, or financial proceeding. It’s a contract between shareholders and a commitment to operate within the bounds of UAE law.

If you are setting up in Dubai, the memorandum of association Dubai jurisdiction falls under the Department of Economic Development (DED), while free zones like DMCC, Dubai South, and RAKEZ have their own rules and templates.

Your memorandum of association UAE structure will also affect your company’s eligibility for certain incentives, trade licenses, and investor visas.

What Do You Need to Know About Updating Your MOA?

When business expands, you pivot and you grow. Your MOA should reflect that. Here’s when you need an update:

- Changing business activity

- Adding or removing shareholders

- Modifying shareholding structure

- Appointing new managers

- Shifting to a new office address

- Changing legal structure

Each of these changes requires legal amendment, notarisation, and re-submission. This is where our team steps up with our end-to-end PRO services that take the workload off your desk and put it on ours.

How We Help You Get It Right & Keep It Right?

We build documents that stand up to real-world tests: banks, courts, audits, and worst-case scenarios. Here’s how our PRO services make your life easier:

- Drafting legally compliant MOAs

- Coordination with DED or Free Zone authorities

- Notarisation and attestation assistance.

- Fast-track amendments when business needs change overnight

- Guidance tailored to your business activity, goals, and future plans

- Multilingual support for Arabic, English, and legalese

In short, we handle the paperwork and the pressure. You handle the strategy and scale.

Conclusion

You wouldn’t build a skyscraper without a blueprint. So why run a company without a solid MOA?

Whether it is a startup that you are launching a startup or an existing entity that might be restructuring, your MOA is your very foundation. It’s what separates a side hustle from a legally functioning company. From partner disputes to bank account delays, a tight MOA keeps things moving without any hassle. So, what is a memorandum of association? It’s what stands between your idea and its legal existence. From memorandum of association UAE requirements to memorandum of association Dubai protocols, we have got your back.

Need help setting up or fixing your MOA? Contact us for our PRO services and let’s get this done right.

FAQs:

Q: Can I register a company without an MOA?

Nope. You literally can’t get a license or open a corporate account without it.

Q: How long does it take to get an MOA drafted?

With our help, it’s usually 1 to 2 working days. Sometimes faster if you need it urgently.

Q: Is the MOA different for Free Zone vs Mainland companies?

Yes. Free Zones have their own formats and some require their own approvals. We handle both.

Q: What if I want to change shareholders later?

You will need to amend the MOA legally. We take care of drafting, notarisation, and submitting to authorities.

Q: Does the MOA need to be in Arabic?

Yes, it must be in Arabic or bilingual (Arabic and English). We provide bilingual documentation.

Q: Can I add clauses that aren’t standard?

Yes. We can customize MOAs to include specific business terms, arbitration clauses, and exit strategy provisions.