One of the most rapidly expanding business locations worldwide, the UAE is enhanced by Dubai’s aspiration status for many company owners. Deliberate government assistance helps businesses to keep ahead of their competitors and increase their scope of operation.

The government provides authority to entrepreneurs to function from anywhere in the world. They can work in a collaborative and changing setting using a virtual corporation formed in Dubai while facilitating corporate convenience.

We share information on acquiring a Dubai virtual company license and its advantages to expand your global presence.

Understanding the Virtual Company License in Dubai

Launching and running a company from a distance is made possible with a Virtual Company License in Dubai. You are not obliged to be in the country by this permission. Establishing companies in Dubai especially depends on this, as it provides international workers with a simple way to interact with the active corporate environment in Dubai.

Virtual companies in Dubai are especially meant for entrepreneurs who do not live in the Emirates. They have to be residents or taxpayers from a certain country. Companies are turning toward virtual company registration in Dubai in an ever-rising digital economy.

Their strong digital framework helps them to function online and run without having to spend money on a physical company setup or migration.

Anyone with a Virtual company license in Dubai, often referred to as a virtual commercial license, can freely engage in any digital business endeavor.

Various Types of Dubai Virtual Company Licenses

Dubai offers three categories of virtual business licenses. Let’s check these licenses and their significance for business owners and entrepreneurs.

Virtual Company Commercial Licenses in Dubai:

A commercial virtual license is for trading goods, imports, and exports, including information technology and advertising services, which may run virtually in a flexible corporate environment.

Virtual Company Professional Licenses in Dubai:

A professional virtual company license in the UAE lets you run your company from anywhere. Freelancers, consultants, and IT experts can easily work from anywhere without acquiring a physical workplace. Their work setting might be flexible and reasonably priced compared to a traditional workspace.

Virtual Company Industrial Licenses in Dubai:

Although they do not include industrial activity, industrial virtual licenses concentrate on service-based sectors. These industrial virtual licenses exclude manufacturing, production, or storage of goods. For a reliable presence in Dubai, you might go for a free zone industrial company with an industrial license.

Dubai Virtual Company License: Perks for Entrepreneurs

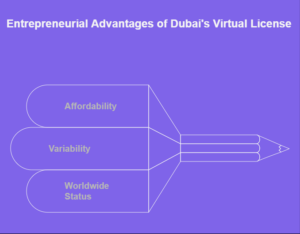

Entrepreneurs and startups wishing to have a presence in Dubai can have a lot of advantages with the Dubai virtual company license. The most significant advantages include:

By removing the requirement for actual office space, virtual business licenses help to save overhead expenditures such as electricity, rent, and upkeep. For businesses, particularly those running on a limited budget, this makes it a reasonably priced option.

Variability:

Unmatched freedom offered by Virtual Company Licenses lets company owners run their businesses from anywhere in the world. Digital nomads, freelancers, and small companies seeking affordable services, including access to shared workplaces, conferences for networking, mentoring programs, and financial incentives meant to foster entrepreneurship and innovation, especially benefit from this adaptability.

Worldwide Status:

On a global scale, Dubai is regarded as a profitable destination with excellent infrastructure and a positive legal framework. Maintaining a virtual company license helps companies running in the area to establish trust and reputation, hence drawing in more customers and partners.

The Dubai virtual company license presents a convincing opportunity for entrepreneurs to start and expand their companies in a vibrant and active business environment with low expenses and great freedom.

Establishing A Virtual Company in Dubai Smoothly

Launching a virtual company in Dubai requires the owner of the company to apply for a Virtual Company License, which can be obtained using these guidelines.

The initial phase is completing a registration form online.

Thirty days will pass for background verification.

It requires an identification and verification visit.

Get the license by paying the license cost.

Virtual Business License: Eligibility and Criteria

- Virtual firm owners in Dubai have to be nationals or tax residents of one of the authorized countries. UAE residents are not qualified to apply for the Virtual Firm License.

- Virtual companies are not permitted to operate in Dubai unless they fit one of the pre-defined industrial categories. Consequently, the designated sectors include software development, support services, design, and technology. Although fashion, clothing, jewelry, interior design, printing, and advertising services are also included.

- Apart from this, virtual entrepreneurs in Dubai should also be aware that their companies will still be liable for the different national taxes.

- Another important consideration is that the Dubai Virtual Company License does not immediately allow any of the business’s participants physical access into the UAE using a business, visiting, or resident visa.

- Furthermore, it is comparable to creating a business bank account. Commercial banks will have exclusive decisions over whether or not to permit account opening.

Virtual Business License: Required Documentation

- Personal information and details.

- Evidence of accommodation, such as a copy of utility bills.

- Validated Passport Copies.

- A letter of recommendation (if required).

- Taxation Certificate

- Current pictures have a white background.

Cost of Virtual Company License in Dubai

The particular package selected and any extra services needed might affect the Dubai virtual company license cost. However, this license can be priced from two thousand five hundred to fifteen thousand AED or more.

It depends on the company’s operations and activities, usually including administration and further processing costs, license issuing fees, and other operational costs related to establishing a virtual corporation in Dubai.

Simplified Process to Acquire a Virtual Company License in Dubai

Usually, the process of getting a virtual corporation license in Dubai consists of the following actions:

Paperwork:

Get ready the appropriate papers, company plans, identity records, and other documentation.

Choose the Company Operations:

Find out the kind of company operations you do and guarantee adherence to Dubai’s laws and licensing criteria.

Complete Application:

Send your Virtual business license application via the relevant approved service provider or online portal. Make sure all necessary data is entered precisely to speed up the handling of your application.

Opt for a Suitable License Package:

Choose an appropriate virtual assistant company licensing package provided by authorized service providers or government bodies of Dubai. Costs, features, and extra services among these packages could differ.

License Acceptance and payment:

Once your application gets submitted, the relevant authorities will evaluate it. Should approval be granted, you will get a communication with guidelines on licensing fee payment.

Receive Virtual License:

You will get your virtual company license online after the licensing payments have been processed, allowing you to start running your firm out of Dubai.

Additional Considerations for Getting a Virtual Company License in Dubai

- Whether in the form of a business, visiting, or virtual work residency visa, the virtual business license will not effortlessly grant physical entry to the UAE to any of the company’s partners or staff.

- Contingent upon the area of economic activity and global tax conventions, virtual companies stay open to corporate, individual revenue, and social levying taxes in the country of incorporation or abode.

- A virtual company license does not necessarily ensure acquiring a bank account in the UAE. Still, access to account opening procedures is made easier.

- Virtual businesses with sole proprietorship legal form are not governed by local ownership, director of operations, auditor, or authorized service provider standards;

- VAT will be charged if the company’s income from the UAE reaches a certain amount. Tax registration with the UAE’s federal tax authorities will be necessary in that case. Virtual corporations are responsible for tax registration. In the United Arab Emirates, VAT is five percent; income taxes are not applied to non-financial companies.

Limitations for Virtual Company in Dubai

The Dubai virtual company license is only accessible for some industries, including printing, advertising services, computer programming, advisory services, fashion, and design.

Final Words

For aspirant entrepreneurs who want to expand their business activities but are reluctant to make investments, company establishment in Dubai may release exponential development potential. See a reputable business expert to help you create even more seamless company processes. KPM PRO is the perfect solution for all business owners and entrepreneurs throughout the licensing process in Dubai.

FAQs:

What is a Dubai Virtual Company License?

A Dubai Virtual Company License allows entrepreneurs to operate businesses remotely in Dubai. They don’t even need a physical office space.

Who is eligible to apply for a virtual company license in Dubai?

Non-resident entrepreneurs or taxpayers from approved countries are eligible. Whereas UAE residents can’t apply for this license.

What types of business activities can be conducted under a Dubai Virtual Company License?

Under a Dubai virtual company license, activities include:

- Software development

- Design

- Advertising

- Fashion

- Printing, and

- Technology-related services

Excluding physical manufacturing or storage.

Which authorities issue the Dubai Virtual Company License?

The Dubai Virtual Commercial City authority manages and issues virtual company licenses through its official online platform.

What are the key documents required to apply for a virtual company license in Dubai?

The documents required to apply for a virtual company license in Dubai are:

- A valid passport

- Tax certificate

- Proof of address

- Photos, and

- Personal or business identification details