There’s now a way to get fired without being financially fried! Financial stress impacts your brain like physical pain. So when job loss hits, it’s not only a career setback. It feels like a full body punch too. But UAE actually has got your back with something practical. And it’s known as ILOE insurance.

It’s not some fancy benefit for the elite. It’s for you, your neighbour, the barista who makes your coffee, and the marketing exec three desks away. If you are employed in the UAE, you are expected to get on board. And honestly? You should want to. Because when life hits pause on your job, this is the thing that hits play on your survival plan.

In this blog post, we discuss this topic, covering everything you need to know about staying paid when work says goodbye.

What Is ILOE Insurance, Really?

ILOE stands for Involuntary Loss of Employment. It is a government-backed insurance scheme designed to keep you afloat when the rug gets pulled out from under you at work. Be it a company downsizing, unexpected restructuring, or a sudden termination that had nothing to do with you, ILOE is the safety net waiting to catch your fall.

Simply put, you pay a small premium every month while you are employed. If you lose your job through no fault of your own, you get a monthly payout for up to three months. It helps you pay rent, buy groceries, and survive the job hunt.

So, who needs this?

- Every employee in the UAE

- Government and private sector workers

- UAE nationals and expats alike

- Mandatory since January 1, 2023

There’s no loophole or lucky exemption unless you are in a very specific category.

Why ILOE Insurance Isn’t Just Another Policy

ILOE insurance UAE actually delivers on what it promises! The policy:

- covers up to 3 months of your salary, helping you stay on your feet

- applies to full-time workers earning up to AED 30,000

- Has low monthly premiums

- Offers fast claims process, with payments issued within two weeks

- Is available to everyone, with multiple platforms to register

It’s a must-have, especially in a job market where anything can change in a quarter. And if you are one of the many who support their family back home? ILOE gives you breathing space to make smart moves instead of desperate ones.

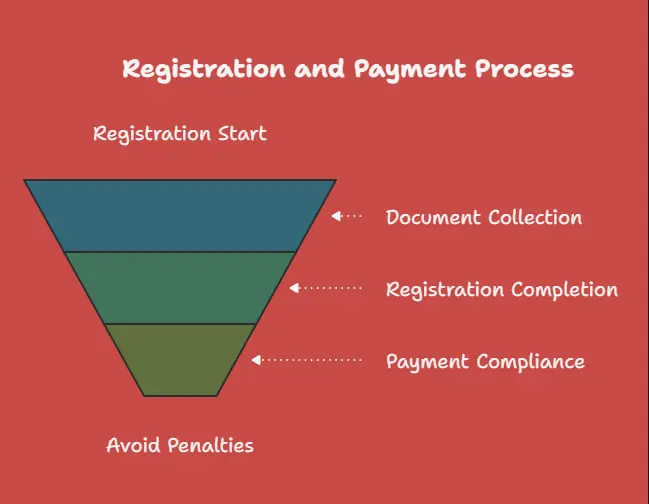

How to Apply for Your ILOE Insurance?

It’s quite easy! We share all the details for how you can sign up for your insurance plan.

Where to sign up:

- ILOE Portal

- Tawjeeh and Tasheel centres

- Al Ansari Exchange locations

- Select bank branches

- Mobile apps and kiosks

- Your trusted PRO outsourcing provider, like KPM PRO

What you will need:

Registration takes about 5 to 10 minutes. These documents are what you will need:

- Your Emirates ID

- A working mobile number

- An email address

- A debit or credit card for payment

Skipping the registration is not an option. If you don’t register within the deadline, you will get fined AED 400. That’s more than the cost of the whole year’s premiums! Plus, if you miss your monthly payment for more than three months, you lose eligibility and get another fine.

What Happens If You Actually Need to Claim?

This is where ILOE insurance actually earns its well-deserved reputation. You lose your job, you file a claim, and within weeks, you start receiving up to 60% of your average salary.

When you can claim:

- You have been enrolled and paid premiums for at least 12 continuous months

- Your job loss was involuntary (not your choice, not misconduct)

- You haven’t left the country or started a new job immediately after

What you will get:

- Monthly payments for up to three months

- 60% of your average basic salary, up to a cap (that would be AED 10,000 or AED 20,000, depending on your category)

- Payouts within two weeks of claim approval

It’s not retirement money, but it’s enough to keep you from spiraling into crisis mode while you figure out your next steps. All claims are made digitally. Upload a few documents, hit submit, and wait for your approval message.

How PRO Services Can Assist You with Bureaucracy

Not everyone wants to deal with government websites, payment reminders, or figuring out whether their insurance plan is active. That’s where PRO services come in.

If you are a business owner or HR manager, you don’t want your team stressing over compliance. That stress trickles down into performance, morale, and even retention. Outsource the hassle, and let us handle it for you. This is a list of what we manage on your behalf:

- Registering your employees for ILOE insurance

- Keeping tabs on due dates, policy status, and renewals

- Managing and submitting claims on your behalf

- Keeping your business 100% compliant with zero effort on your end

PRO outsourcing puts your workforce on autopilot so you can focus on growing the business, instead of stressing over regulations.

Who Can Skip It For Now?

The list is short. Most people working in the UAE need to register. But there are a few exceptions:

Exempt groups include:

- Domestic workers

- Investors or business owners (who are not salaried employees)

- Temporary contract staff

- People under the age of 18

- Retired individuals who are still working on a pension visa

If you don’t fit in any of those categories, you are expected to enroll. And if you are not sure? Ask a PRO service provider.

Busting Common ILOE Myths

Misinformation spreads fast. Let’s put these ILOE misconceptions to rest.

“This is just another tax.”

Not even close. This is you paying to protect yourself from unemployment. Think of it like car insurance. You don’t want to use it, but you are glad you have it.

“My employer should cover this.”

They don’t. They can assist, but this one’s on you. Consider it professional self-care.

“I will never need it.”

Famous last words. Even top performers face layoffs. ILOE is all about preparing yourself wisely.

“It’s hard to claim.”

Nope! The UAE made the system digital, transparent, and efficient. You can do it from your phone.

Why Businesses Should Care About ILOE

It might be individual-based, but businesses play a crucial role. If your employees are out of the loop or non-compliant, that reflects on your operations. Smart businesses help their staff register, stay informed, and feel secure. Here’s what you can do:

- Include ILOE registration in onboarding packets

- Offer guidance via your HR or admin team

- Use PRO outsourcing to automate the entire process

- Reassure your team that you are invested in their stability

Workplaces that take care of their people? That’s a competitive edge. Plain and simple.

Conclusion

We live in unpredictable times. Contracts shift. Companies pivot. Departments vanish overnight. And while you can’t always control what happens, you can definitely control your response.

ILOE insurance is one of the most practical tools available in the UAE today. It’s not you living in fear. It’s about your freedom the freedom to breathe, regroup, and re-enter the job market with your dignity and wallet intact.

And if you want to make it even easier? Let a trusted PRO services guide do the work. We are already helping companies and individuals make sense of ILOE, register their teams, and stay compliant without them having to lift a single finger.

FAQs:

How much does ILOE insurance cost?

The ILOE insurance costs between AED 5 to AED 10 monthly, depending on your salary bracket. That’s less than most people spend on snacks.

What if I switch jobs?

Your insurance follows you, not your job. Just update your information on the ILOE portal.

Can I opt out?

Unless you are in an exempt category, no. It’s legally required.

How often do I need to pay?

You can choose to pay monthly, quarterly, or annually. Just don’t miss payments or your coverage is suspended.

How do PRO services help with ILOE?

They register, monitor, renew, and even handle claims. You get full coverage without the admin workload. Want us to sort this out for you? Let our expert PRO team handle your ILOE registration, compliance, and claims with zero stress. It’s a smart business that actually gives back when it counts.