If you want to obtain a PSP license in the UAE, you’re on the right path to accessing the rapidly developing field of digital payments. With a PSP license, you may provide companies and customers with online payments, electronic wallets, and other payment options. The UAE boasts a clean and friendly fintech business environment, making it an interesting starting area.

To assist you in comprehending the procedure quickly, we’ll briefly go over everything you require to understand about acquiring a payment service provider license in the UAE. We will guide you through every aspect of the process, from identifying the fundamental prerequisites to submitting your application.

Understanding a Payment Service Provider’s Functions and Importance

A payment service provider license is a firm or monetary institution that enables an internet-based company to accept payments. It enables them to receive customer payments through a range of channels. PSPs deliver the infrastructure and technological tools required to process payment transactions. PSPs serve as mediators between retailers, financial firms, and banks. It may provide extra services like fraud prevention, periodic billing, and converting currencies.

Functions of UAE Payment Service Providers

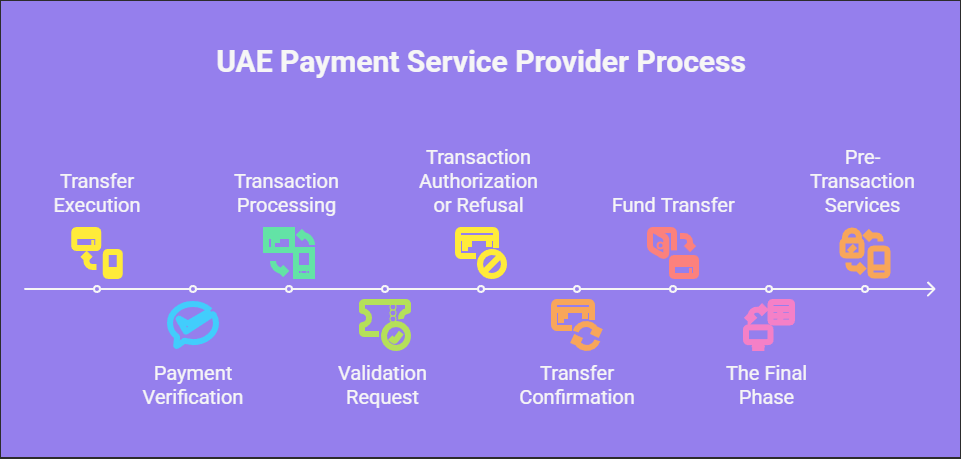

A Payment Service Provider connects retailers, consumers, and financial organizations. There is an easier explanation of how a PSP works:

Transfer Execution

Transfer Execution

Transfer execution occurs when a consumer buys products or services from a digital business and chooses a specific mode of payment. The vendor has linked the PSP’s payments system to their website or app to ensure a safe transaction.

Payment Verification

The consumer inputs payment details, such as credit card data) on the merchant’s web portal for payment verification. The data is digitally encrypted and transmitted to the PSP’s payment system.

The payment service provider UAE sends the transaction details to the acquiring bank for additional processing.

Transaction Processing:

The acquiring bank forwards payment data to the credit card network or the bank’s payment processor.

Validation Request:

The payment card network or processor sends an inquiry to the issuing customer’s bank to ensure that the funds are accessible and the transaction is authentic to prevent fraud.

Transaction Authorization or Refusal

The issuing Bank replies and verifies that the customer’s account has enough cash or credit, then sends a confirmation or denial message. Communication is sent back over the credit card network, and the bank is obtained from the PSP. The results are then submitted to the merchant’s authorized or denied system.

Transfer Confirmation

Confirmation and authorization of payment transfer are essential. If the transaction is accepted, the money is briefly kept in the seller’s account. The vendor confirms the customer’s order approval and payment success.

Fund Transfer

The payment service provider license facilitates the funds transfer from the customer’s bank to the merchant’s bank for funds settlement and approval.

The Final Phase:

Once the funds have been transferred and the transaction is completed, PSPs frequently provide data reporting features to the traders and help them monitor their transactions.

Pre-Transaction Services

To ensure fraud protection and security, payment service providers (PSPs) provide solutions such as encryption, encoding, and systems for identifying fraud.

Conflict Resolution:

If a consumer rejects a transaction or disputes charges, the PSP may help resolve the conflict between the client and the vendor.

In short, a PSP offers the necessary resources and infrastructure for safely and effectively processing, authorizing, and settling payments, allowing businesses and consumers to execute transactions conveniently.

UAE Payment Service Provider License Types

The UAE’s legislative structure for recorded values and digital payment systems classifies payment service provider licenses into four groups. Below is the classification of each type:

Retail PSP

These are approved commercial banks and other recognized PSPs that provide electronic payments to the retail sector, government, and private sector. They also make cash remittances easier, allowing customers to transfer funds electronically. To lawfully offer such products and services as a retailer PSP, companies have to acquire a payment service provider license in UAE.

Non-Stored PSPs

These businesses don’t offer financial storage services, and they do not keep customer funds but offer electronic payment alternatives. They support government, retail, and collaborative electronic payments but do not store cash. For continued operation in the UAE market, these PSPs must follow the legal structure and secure the required PSP license in Dubai.

Governmental Regulated PSPs

These PSPs are intended explicitly for federal and local governments, allowing them to offer electronic payment methods for services to the public, taxes, penalties, and other government-related activities. These services must also be regulated in the UAE, and the PSP license is granted to guarantee that they satisfy all legal criteria.

Micro Transactions PSPs

This form of PSP specializes in providing payment methods for minor transactions, frequently serving the without banks and underprivileged communities. Micro-transactions PSPs allow online payment for low-cost transactions using portable wallets or other internet channels. Businesses that provide such services in Dubai require a PSP license to ensure compliance with local legislation.

Essential Steps to Acquire UAE Payment Service Provider License

To offer payment solutions properly in the UAE, firms must initially go through a certain regulatory procedure established by the UAE government. Below is an easy procedure for applying for a payment service provider license in the UAE:

Understand the Payment Service Provider License Legislative Framework

The UAE Central Banking Authority is the primary organization that oversees payment service providers in the region. To legitimately operate as a payment service provider company in the UAE, businesses must adhere to the Center Bank’s laws.

Eligibility Criteria and Further Requirements for Payment Service Provider License

The firm’s request must fulfill qualifying conditions, including being an authorized business in the UAE. It must have sufficient facilities and infrastructure to provide payment solutions, such as safe payment channels or financial institutions, and meet the capital requirements of the regulated authorities.

Choose the Suitable Business Setup for the Payment Service Provider Company

Determine whether to establish your firm in a free zone, mainland, or offshore in the UAE since this could affect the licensing procedure.

Starting a business in Dubai allows you to receive a PSP license. It allows you to operate within the city and throughout the UAE. Various free zones in the UAE also issue payment service provider licenses, however the limits differ according to jurisdiction.

Preparation for the Required Papers

Paperwork commonly requested includes a company plan and proof of compliance. Identification paperwork for every shareholder and executive.

Submit the Payment Service Provider License Application to the UAE Central Bank

Request for a payment service provider license in the UAE through the UAE’s central authorities, along with the relevant papers. This request will be examined to ensure compliance with UAE laws and financial standards.

Receive Approval for the Payment Service Provider License from the Central Bank

Following acceptance, the Central Bank will assess your application. Once authorized, you will receive a PSP license in the UAE. This license permits you to provide payment services throughout the country legitimately.

Comply with UAE Laws for Payment Service Provider License

Once licensed, you must meet the UAE’s continuous legal obligations, which include frequent audits, reporting, and adherence to the required criteria.

Start Payment Service Provider Business Operations in the UAE

Once you’ve received your payment service provider license in the UAE, you may start selling payment solutions to customers. Following these procedures, you can receive a PSP license in the UAE and provide payment services in Dubai and elsewhere.

UAE Payment Service Provider License Criteria

You must fulfill the following requirements to receive this license in Dubai;

- You need to choose the company legal structure for the corporation or branch in the UAE Free Zone.

- Application requirements include submitting a business plan, demonstrating financial stability, and passing a fitness test for key individuals.

- Minimum capital needs range between AED one million and AED five million.

- For compliance, you require strong data protection standards.

- Secure payment methods and data security are essential.

- You must fulfill legal requirements, including periodic audits and financial reporting.

- Regulatory supervision includes ensuring compliance with the monetary authority of the UAE rules.

Final Words:

Finally, obtaining a Payment Service Provider license in the UAE is required for electronic payment organizations. The uncomplicated approach enables businesses to operate in a secure, regulated atmosphere that develops client trust. Businesses that follow the requirements and comply with local rules can successfully obtain a PSP license in the UAE and offer payment options to customers.

FAQs:

What is a Payment Service Provider (PSP) license in the UAE?

A PSP license allows companies to process online payments and provide financial transaction services legally.

Who issues the PSP license in the UAE?

The Central Bank of the UAE is the primary authority issuing PSP licenses.

What are the types of Payment Service Provider licenses available in the UAE?

Licenses include Payment Initiation, Account Information, and full Payment Service Provider categories.

What is the minimum capital requirement for obtaining a PSP license in the UAE?

Capital requirements depend on license type and business model, as determined by the Central Bank.

What documents are required to apply for a PSP license in the UAE?

A detailed business plan, company documents, compliance policies, and financial statements are required.